Taking your pension early? Your options explained.

Taking your pension early? Your options explained.

In my last post I highlighted some really important things to consider before taking cash from your pension early. Hopefully you have considered how you will fund your retirement for up to 30 years and understand the tax implications of taking cash early.You are now ready to consider the best way to take cash from your pension.

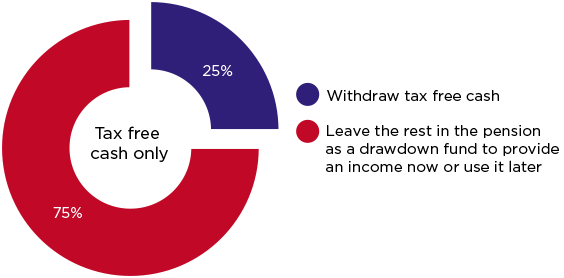

1. Take The Full 25% Tax Free Cash Sum In One Go.

You can take up to 25% of your pension pot as a tax free lump sum. If you take all the 25% tax free sum in one go you cannot leave the remaining 75% untouched. There are three options you must choose from including:-

- Buy a guaranteed income or annuity

- Invest in an adjustable income or flexi access drawdown

- Withdraw the full pension pot as cash

2. Take The 25% Tax Free Sum in chunks.

You can take smaller cash sums from your pension pot without paying tax on 25% of each chunk, the remaining 75% can be taken as taxable income. By taking part of your pension and leaving the rest in the fund you will still have unused tax free cash to be taken in the future.

An example of some of your options assuming a pension pot of £50,000

3. Buying a lifetime income or annuity.

For example, if you have a pension pot of £50,000 you could take £12,500 as a tax free lump sum and buy a taxable annuity for approximately £1700pa.

The amount of your annuity will depend on several factors, how much you have in your pension pot when you buy an annuity, your age, your health, whether the annuity increases each year and if it continues to pay someone else after your death.

There are lots of different types of annuity and rates can vary so it is important to shop around, you do not have to buy your annuity from your current pension provider. Recent research shows 8 out of 10 people would have got a better deal if they had shopped around and purchased from a different provider.

For those in poor health an enhanced or impaired annuity may pay more than a standard annuity.

4. Flexi Access Drawdown

After taking 25% of your pension pot as a single tax free lump sum the remaining 75% is invested to give you a regular taxable income. The regular income is adjustable and you can change the amount, or when you take it, or take cash sums if you need it.The option is also known as Get an Adjustable Income. The value of the pot can go up and down.

Not all providers offer this option, if your current provider does not offer this option you can transfer to another provider, there maybe a fee for doing so.

For example if you have a pension pot of £50k at age 55 you can take a tax free sum of £12,500 and a regular income of about £1700pa until age 85. The life expectancy of a man aged 55 is mid to late 80's so you will need to research and select an income that suits your needs.

Risks associated with how a pension pot is taken according to option selected

Option

|

Instant access to pot

|

Avoid higher tax implications

|

Danger of money running out

|

Withdraw All Pot

|

Yes

|

No

|

Yes

|

Drawdown

|

Yes

|

Yes

|

Yes

|

Annuity

|

No

|

Yes

|

No

|

|

Comments

Post a Comment